Ather’s EV Scale-Up: Transforming India’s Two-Wheeler Economics

India’s two-wheeler market—over 70% of 200 million vehicles and one-third of transport emissions—stands at a tipping point. Ather Energy’s plan to ramp to 500,000 annual electric scooters by March 2027 isn’t just about volume; it’s a strategic lever to drive cost parity, unlock new revenue streams, and accelerate decarbonization.

1. Business Impact Overview

Executives should care because Ather’s scale-up delivers:

- Sub-₹1/km operating cost—40% below petrol scooters, boosting ROI for fleet and retail customers.

- ₹105 million capex program—split ₹60 M for factory expansion, ₹35 M R&D, ₹10 M digital initiatives.

- Robust charging network—4,000+ chargers (50 kW depot, 10 kW public) reducing customer range anxiety.

- Supplier de-risking—20% cheaper LFP battery packs, diversified magnet sourcing, 90% battery recycling.

2. Production Ramp & Unit Economics

Ather’s third factory in Hosur, Tamil Nadu, features three 14,000-unit/month lines, targeting:

- Q3 2025: 100,000 units/year (8,300 units/month)

- Q2 2026: 250,000 units/year (20,800 units/month)

- Q1 2027: 500,000 units/year (41,600 units/month)

At 100k annual volume, pack costs run ₹25,000/unit; at 500k, they drop to ₹20,000 (20% savings). Overall manufacturing cost falls from ₹85,000 to ₹72,000, driving gross margins above 18% by 2027.

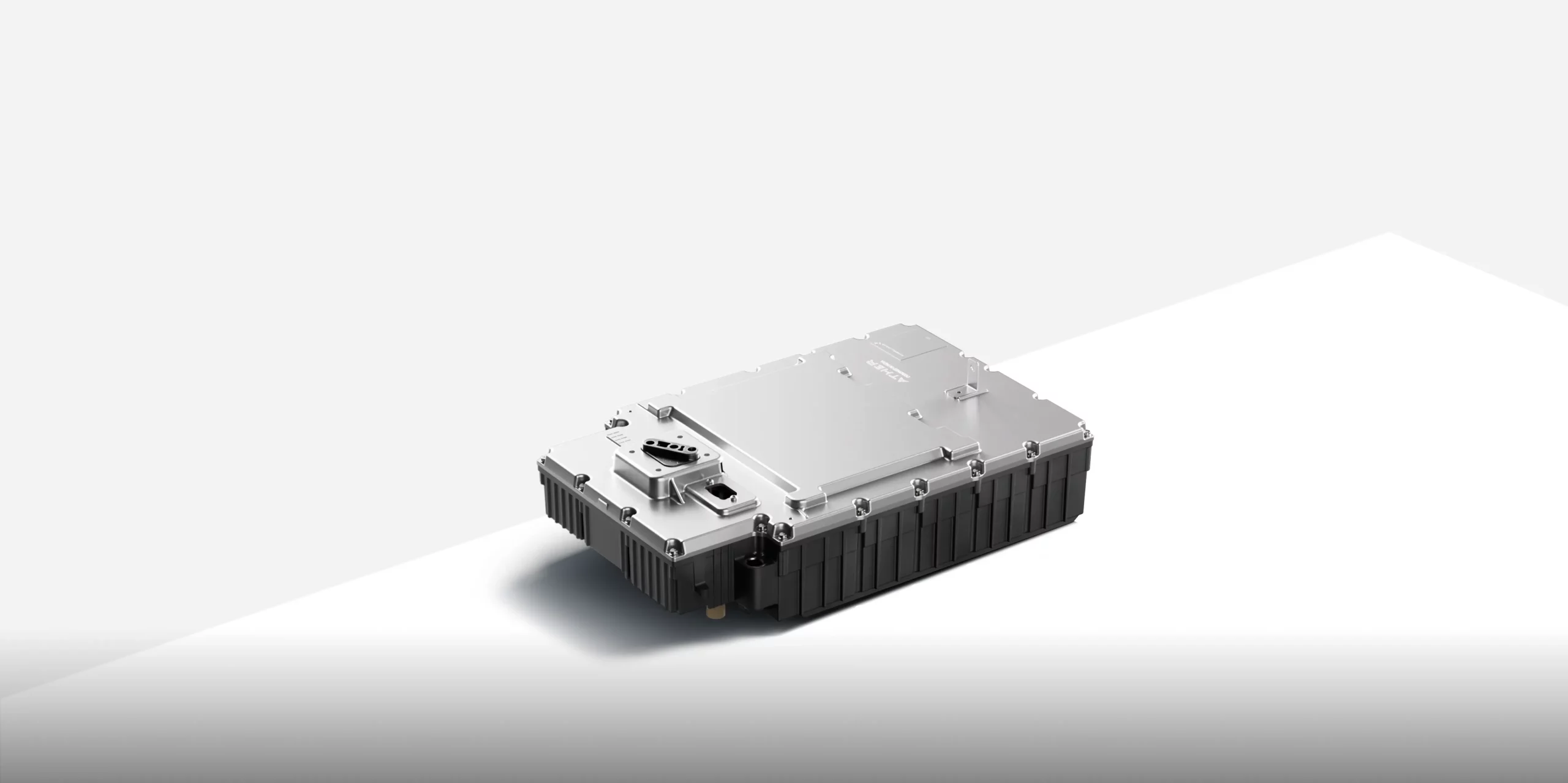

3. LFP Pivot & Supply-Chain Resilience

Shifting from NMC to LFP cells unlocks critical cost and safety advantages:

- Cost Delta: ~20% cheaper battery pack (<₹20,000 vs ₹25,000).

- Energy Density: 140 Wh/kg vs 160 Wh/kg, yielding a 130 km range vs 145 km—acceptable for 70% of urban commutes.

- Cell Suppliers: Primary contracts with China’s EVE Energy and India’s Sunrise Group for localized volume.

- End-of-Life: 90% material recovery via partnerships with GNR Lithium and Tenvia Recycling.

“Our LFP transition secures margins and supply stability,” says Tarun Mehta, Ather CEO.

4. Charging & Ecosystem Services

Ather’s 4,000-point network includes:

- Public 10 kW fast chargers every 15 km in metros.

- 50 kW depot chargers for fleet operators, enabling 80% charge in 35 minutes.

Ather also bundles financing (EMI plans with 1–3 year tenors), battery warranties, and usage-based insurance. Morgan Stanley analyst Shalini Gupta notes, “EV two-wheeler TCO parity by 2026 is within reach, driven by LFP and network scale.”

5. TCO & Adoption Metrics

Comparing Ather LFP scooters vs ICE:

| Metric | Ather LFP | Petrol Scooter |

|---|---|---|

| Operating Cost/km | ₹1.00 | ₹2.50 |

| Maintenance Cost/yr | ₹2,500 | ₹5,000 |

| Payback Period | 18 months | – |

Rizta sales: 102,000 units (July 2024–June 2025), highlighting that practical range and price (<₹1.25 lakh ex-showroom) drive mass appeal.

6. Actions for Business Leaders

- Evaluate Joint Ventures—co-invest in LFP cell lines to lock in cost and volume.

- Integrate Charging Solutions—partner on depot and public hubs to secure fleet deals.

- Bundle Financial Services—offer EMI, battery-as-a-service, and usage insurance via digital platforms.

- Pilot Industrial Fleets—target ≤24-month TCO payback in Tier-2/3 cities; track uptime, cost per km.

7. Next Steps & Contact

To explore collaboration with Ather’s strategic partnerships team or schedule an executive briefing, contact partners@atherenergy.com or visit atherenergy.com/business.

Leave a Reply